Current issue

Spring 2024

#243

-

For Palestine, bring the Hague home!

The genocide in Gaza demands we fight for Palestine, by targeting circuits of power elsewhere. Toufic Haddad writes from Jerusalem

-

Islamophobia and spectacles of Muslim death

Bad-faith policing of anti-semitism has led to rampant Islamophobia. In the global north, we have become conditioned to watching Muslims die, argues Maura Finkelstein

-

Keir Starmer’s bad history

With his insights as a historian of the modern UK, David Edgerton looks at Labour’s new affinity with the Tories

-

Listening with Stuart Hall

The academic and activist died ten years ago. Dialogue and engagement were among his many lasting gifts, write Yasmin Gunaratnam and Mike Dibb

From our archive

-

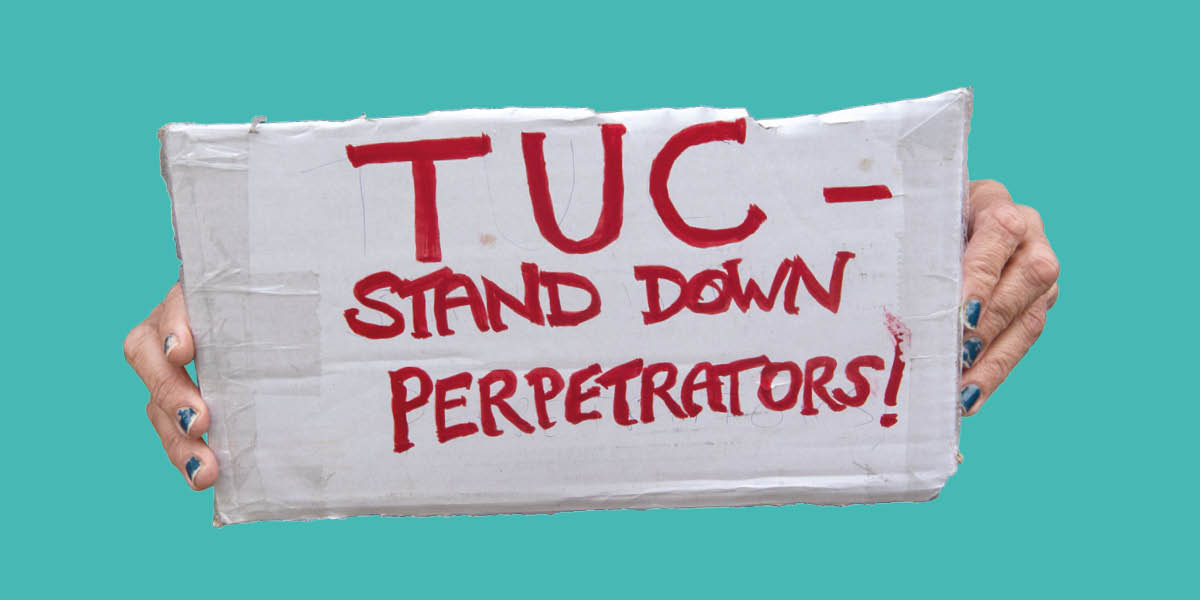

The lies we tell about men who kill

Mental health crisis is often used to explain mass murder. The framing only detracts attention from tackling misogyny and male violence, argues Alex Birch

-

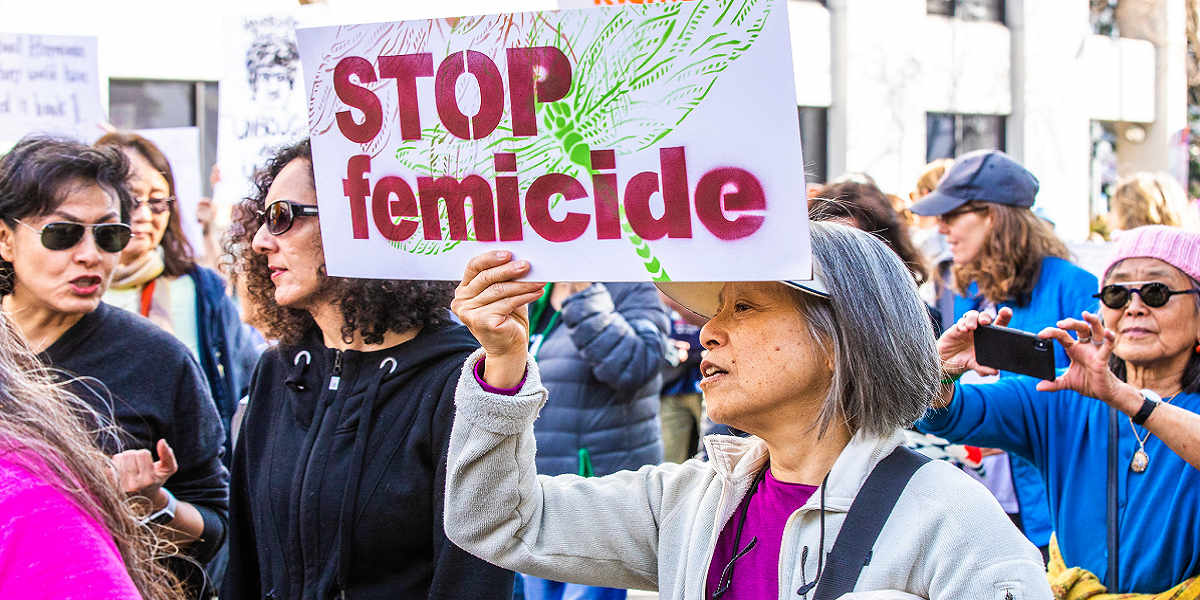

Mahsa Jina Amini’s death sparked an ongoing feminist revolution in Iran

Women, and particularly young women, are leading an increasingly noisy revolution against Iran’s theocracy, writes Ahou Koutchesfahani

Subscribe to Red Pepper Magazine

Fed up with the mainstream media?

Support radical, challenging, independent media instead!

Subscribe now to receive the quarterly print

magazine delivered to your door.

Plus access to our full digital archive –

over 230 issues going back to June 1994!

SUBSCRIPTIONS ALSO

SUPPORT EMERGING WRITERS

AND FUND OUR EVENTS AND

CAMPAIGN WORK.

About Red Pepper

Red Pepper magazine is a quarterly publication and website of left politics and culture.

We draw on socialist, feminist, green and anti-racist politics.

We seek to be a space for debate on the left, a resource for movements for social justice, and a home for open-minded anti-capitalists.